2023 MnSHIP Table of Contents

Chapter 3

Revenue Outlook

Revenue Outlook

MnSHIP is a fiscally constrained plan, meaning it sets investment priorities only for the revenues that are expected to be available during the next 20 years. MnDOT identified the various revenue sources that are used to fund the state highway system and analyzed the trends affecting these revenues. This analysis provided the information necessary to develop revenue assumptions and projections for the 20-year planning period. Appendix C: Financial Summary presents an in-depth review of Minnesota’s state highway funding and the revenue projection scenarios that could influence available funding over the next 20 years.

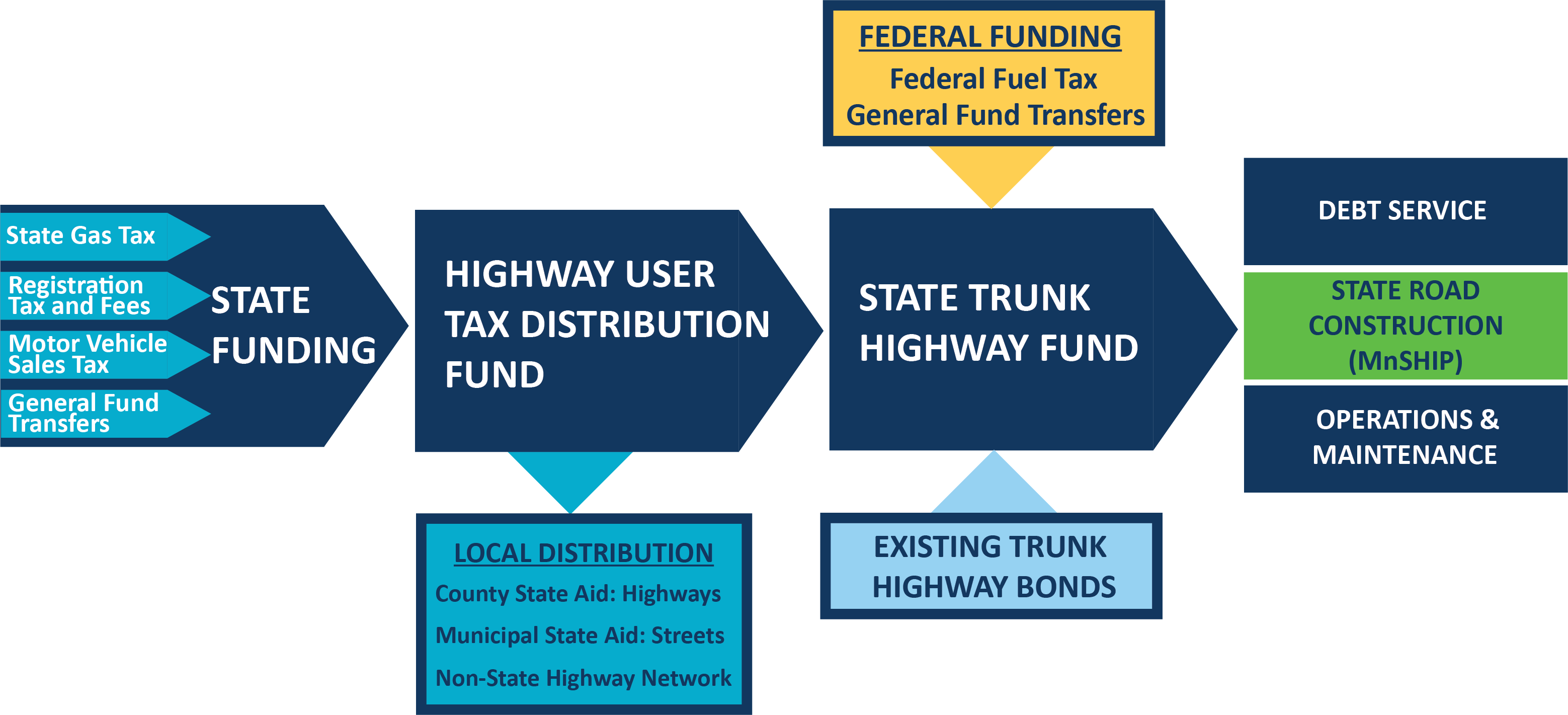

Several state and federal revenue sources provide dedicated transportation funding including for construction projects on the state highways system (Figure 3-1). Four primary sources provide funding to the State Trunk Highway Fund. These sources are:

- Federal gas tax and general funds

- State gas tax

- Motor Vehicle Registration Tax

- Motor Vehicle Sales Tax

In 2017, the Minnesota Legislature provided additional funding by statutorily transferring some existing transportation related revenue (e.g., sales tax on auto parts) to the Highway User Tax Distribution Fund. These transfers are assumed to continue. Existing state trunk highway bonds (i.e., bonds authorized by the Minnesota Legislature at the time MnDOT developed the revenue projections) are also included in the MnSHIP revenue projections.

Figure 3-1: Minnesota's Primary Transportation Funding Sources for State Highways

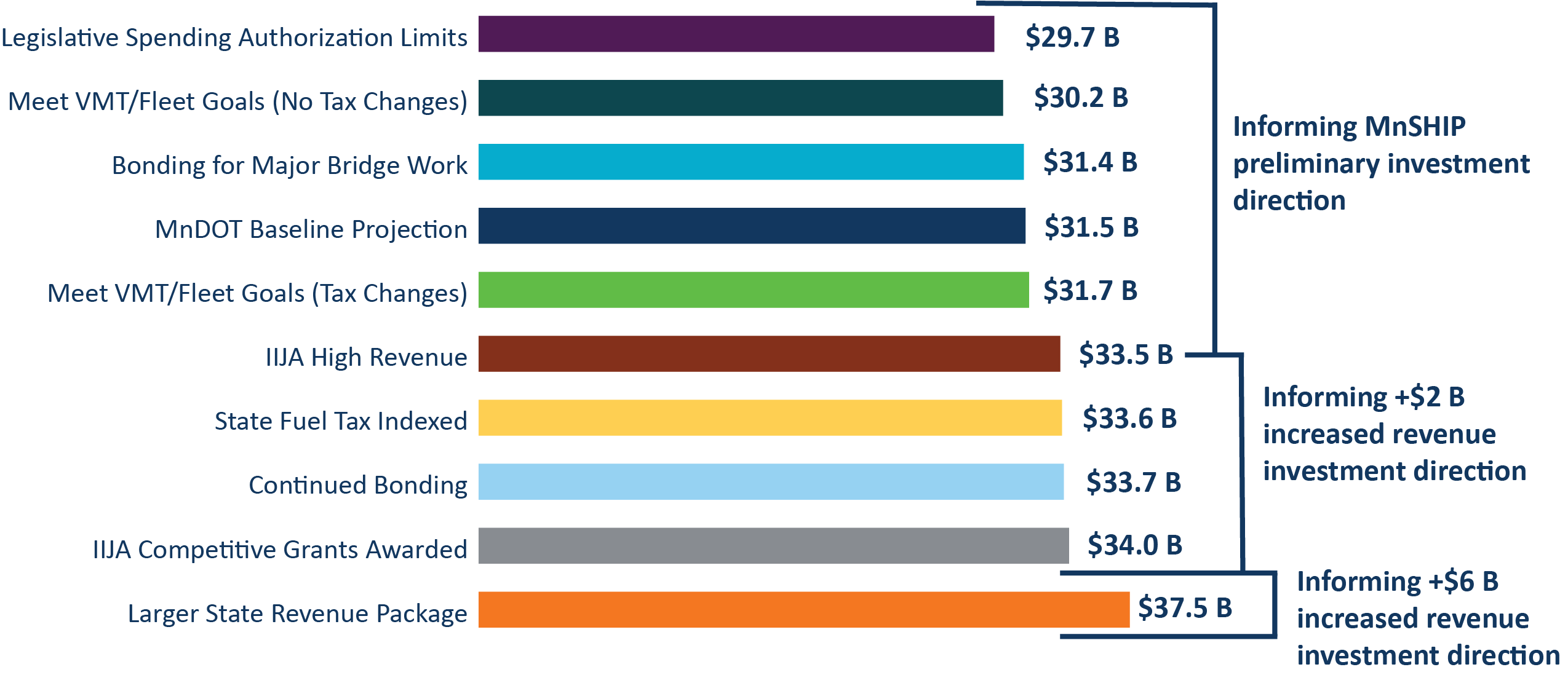

20-year projections inherently have a high degree of uncertainty. To account for potential new federal or state laws, trends and other funding factors that could change the anticipated future revenue, MnDOT developed a series of revenue scenarios. These revenue scenarios present a range of possible funding estimates over the 20-year planning horizon, but do not represent all possible combinations or possible futures. Based on these revenue scenarios, MnDOT used a range of $30 to $33 billion to inform the development of an initial draft investment direction.

In 2023, after the revenue projections had been completed and a draft investment direction had been developed, the Minnesota legislature passed a bill providing additional funding for transportation. This increased the anticipated capital funding for state highways by $5.2 billion over the next 20 years. The sections below describe the process for developing the original MnSHIP revenue scenarios as well as changes due to the 2023 legislation.

Federal Revenue Trends

Federal funding of state highways comes primarily through taxes on the sale of gasoline and diesel fuel which are collected in the Highway Trust Fund. The federal gas tax remains at 18.4 cents-per-gallon and was last raised in 1993. Since 2008, revenue from the federal gas tax has not been sufficient to cover federal spending on transportation. As of 2022, congress has transferred $200 billion from the Treasury’s unrestricted-use General Fund to the dedicated Highway Account to cover the additional spending.

Infrastructure Investment and Jobs Act

The Infrastructure Investment and Jobs Act (IIJA), also known as the Bipartisan Infrastructure Law, was signed into law in November 2021. For the purposes of MnSHIP, IIJA provides federal formula funding from 2022 to 2026 for highways and bridges as well as competitive grant funding. MnDOT must make some assumptions about the levels of future federal funding after the bill ends in 2026. MnDOT anticipates most federal formula program funding for highways to continue past the IIJA years.

Federal Discretionary Grant Programs

IIJA includes an unprecedented amount of competitive grant funding (more than $100 billion) to states that strive to improve outcomes in areas of safety, asset preservation, carbon reduction, climate resiliency, restorative justice, technology and more. Minnesota will be eligible to compete for this funding and is well positioned to add new programs, plans and funding for carbon reduction, climate resiliency, restorative justice, broadband and electric vehicle infrastructure into the transportation system. It is likely that MnDOT will receive grants from these federal discretionary programs for state highway projects. Since these programs are competitive, MnDOT cannot assume a funding level from these programs. As a result, these funds are not included in the MnSHIP revenue projections. Any federal discretionary grants awarded to MnDOT would be in addition to the MnSHIP revenue projections.

Initial State Revenue Trends

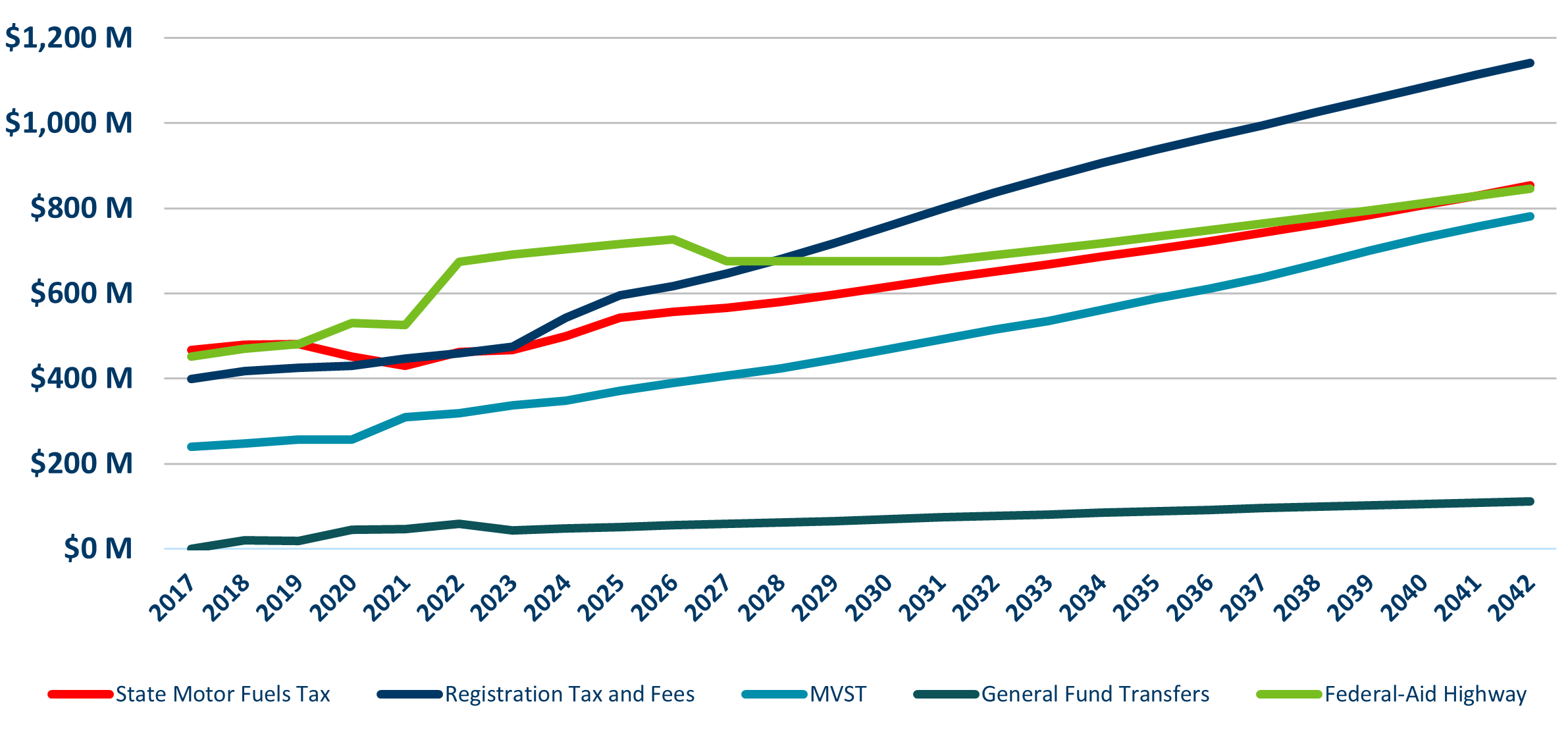

State Gas Tax

The 28.5 cents-per-gallon state gas tax was fixed and has not increased or decreased with the price of gas. This has changed with the 2023 legislation. Those changes are detailed in the Final 20-year Revenue Projection section.

Recently, state gas tax revenues fell slightly due to less travel during the COVID-19 pandemic. While the forecast anticipates state gas tax revenues to rebound post-pandemic, improvements in vehicle fuel efficiency mean that a tank of gas will go farther in the next 20 years. The overall impact is a slight annual decline of -0.5% in state gas tax revenue, turning what was, before the pandemic, the number one contributor to state highway funding into the 3rd largest source of state revenue by the mid-2030s.

Motor Vehicle Registration Tax

Popularly known as “tab fees”, revenue growth is based on the growing average vehicle prices and increasing numbers of vehicles registered in the state. Tab renewal fees, based on initial vehicle pricing, provide an ongoing revenue boost. Electric vehicles also pay an additional $75 surcharge in registration tax. The motor vehicle registration tax (including the EV surcharge) is predicted to be the largest revenue source in the State Trunk Highway Fund by 2025. The method for calculating the annual fee for vehicles was changed by the 2023 Legislature.

Motor Vehicle Sales Tax

While new vehicle sales have slowed recently, higher vehicle prices are driving the growth of revenues. Motor Vehicle Sales Tax is predicted to rise at a higher rate than anticipated in the previous revenue projections for the 2017 MnSHIP. The 2023 Minnesota Legislature also increased the sales tax rate on motor vehicles, which will increase the amount of revenue generated by the tax.

General Fund Transfer Revenues

In 2017, sales tax on auto parts, motor vehicle rental and sales tax and motor vehicle lease sales tax were transferred from Minnesota’s General Fund to the Highway User Tax Distribution Fund by the Minnesota Legislature. These funds provided a modest boost to transportation funding. These transfers are assumed to continue and grow slightly over the next 20 years. However, these taxes are different than the other three state revenue sources because they are not constitutionally dedicated to transportation and could be transferred back to the General Fund by the Minnesota Legislature.

State Bonding

In addition to the four main sources of funding, Minnesota also sells transportation bonds to support highway improvements. The primary purpose of these and other transportation bonds is to enable MnDOT to accelerate the delivery of projects and avoid construction cost increases due to inflation. However, bonds should be understood as a financing approach, as they must be repaid with interest from state trunk highway funds.

Since 2017, the Minnesota Legislature has authorized $1.2 billion in trunk highway bonds for improvements to the state highway system and $900 million in bonding for the Corridors of Commerce program. It is anticipated that $1.4 billion of these bonds will fund projects in the first 4-5 years of this MnSHIP.

Only existing state trunk highway bonds are considered a part of the MnSHIP revenue projections. Any potential bonding that comes after the adoption of this plan is not reflected in the investment direction in MnSHIP.

Initial 20-Year Revenue Projection

MnDOT developed a series of revenue scenarios representing a range of possible funding over the 20-year planning horizon to account for potential new federal or state laws, trends and other funding factors that could change the anticipated future revenue. Based on these revenue scenarios, MnDOT used a range of $30 to $33 billion to inform the development of a draft investment direction. The MnSHIP project team used the midpoint of this range to set the preliminary investment direction of $31.5 billion. Figure 3-2 presents the full range of initial revenue scenarios from $29.7 billion on the low end to $37.5 billion on the high end over the 20-year planning horizon. More detail on these revenue scenarios is available in Appendix C: Financial Summary.

Figure 3-2: Revenue Scenarios Impact on Draft MnSHIP Investment Direction

The increasing revenue scenarios set the basis for the increased revenue budget that was used for the second round of public engagement. The public was asked for their priorities to spend up to an additional $6 billion for state highways.

Final 20-year Revenue Projection

Immediately after the second round of public engagement closed, the state legislature passed a bill that increased transportation funding for MnDOT.

These changes resulted in an estimated additional $5.2 billion for state highways over the next 20 years. The change in funding by component is:

- Gas Tax: +$2.5 billion. Starting in 2024, the per-gallon state gas tax rate will be tied to historical levels for MnDOT’s construction cost index (CCI) which tracks inflation for building roads and bridges. Annual rate increases will be capped at 3% from 2026 onward (the annual average CCI growth rate has exceeded 4% over the long run). Because crude oil is a major cost driver for pump prices as well as construction activity, indexing the gas tax in this way is designed to better balance tax revenue and investment cost.

- Registration Tax: +$2.0 billion. Upcoming adjustments include raising the registration tax rate—from 1.285% to 1.575%—and slowing the vehicle depreciation schedule over the lifetime of cars and trucks. In combination, the higher rate and vehicle value factors generate annual growth of 4.5%, widening the lead that registration tax is expected to hold over all other funding sources in the later years of the plan.

- Motor Vehicle Sales Tax: +$400 million. The sales tax rate on motor vehicles will match the general state sales tax rate of 6.875%, up from today’s 6.5%. Modestly accelerating future MVST growth, it is still forecast to remain the smallest share of constitutionally dedicated revenues.

- General Fund Transfer: +$300 million. Previously held at a fixed amount, the General Fund contribution from auto parts sales will be adjusted to increase over time, with annual inflation modeled at 3%. All elements of the General Fund transfer remain subject to revision in future legislation, but this risk is limited by the size of the transfer relative to total funding allocated to construction—less than 10% for the duration of the plan.

Figure 3-3: State and Federal Revenue Trends (state highway share): Flows into Trunk Highway Fund through 2042

The final 20-year revenue projection for MnSHIP is $36.7 billion for state highway construction. This is the funding level used for development and adoption of the final investment direction as described in Chapter 6: Investment Direction.